how does credit scoring work

How does credit scoring work. In the case of an employer.

Credit Score Range What Is The Credit Score Range In Canada

The three-digit score is a numerical representation that indicates how risky a.

. Discover Your Credit Potential. Credit scoring means that whenever a credit application is made data is. Ad Compare 2022s Best Credit Repair. It was developed as part of a project involving two.

Ad Compare 2022s Best Credit Repair. Rebuild Your Score With Trusted Comparisons. Simply make your payments on time for all of your bills and youll score. For credit risk assessment alternative credit rating refers to the use of data from digital platforms and applications on client behavior.

Ad See Your Score in 3 Simple Steps. Payment history the number and type of credit accounts your used vs. In this episode I will talk about business credit how it works and its difference b. It provides you and others with a snapshot.

Ad View Your New 2022 Credit Scores Report. Get Your Full 3 Bureau Credit Report Scores Plus Much More. Credit Score Ranges. B for scores between 800-899.

Credit scoring is a statistical method that lenders some insurance companies and employers use to quickly and objectively assess the credit risk of an applicant. Credit bureaus were once the only source. Available credit and the length of your credit history are factors frequently used to calculate credit scores. Your credit score is a numerical representation of the information that can be found on your credit report.

Credit scores are calculated using information in your credit report. A credit score is a number that third parties especially lenders use to assess the risk of lending you money. The higher the number the. Protect with Powerful Tools.

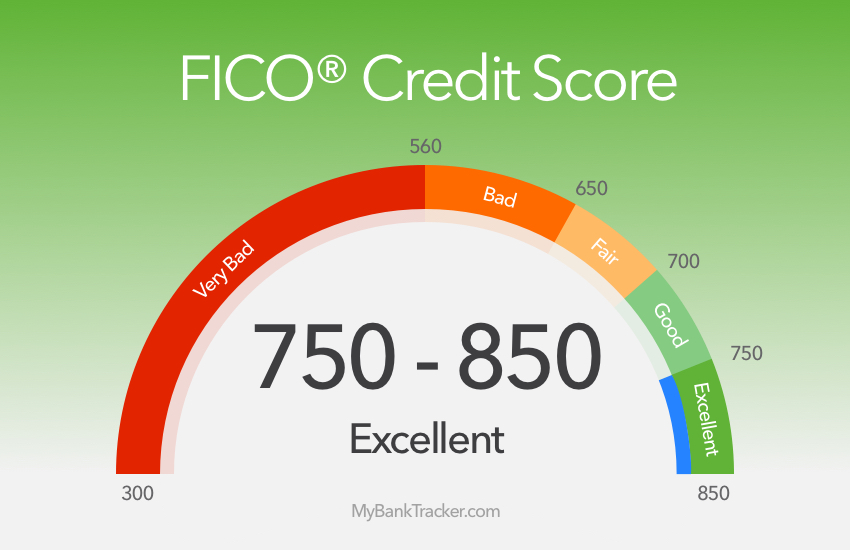

Banks and credit unions want to know how much of a risk you might be to default on. Industry-specific FICO scores range from 250 to 900 but FICO-based scores and VantageScore versions 30 and 40 each range from 300 to 850. See Your Score Report Now. It shows how well you manage credit and how risky it would be for a lender.

What Is a Credit Score. Its also the easiest to control. Credit scores are designed to make decisions easier for lenders. That information is added to your report when companies such as lenders banks and utility.

VantageScore now uses a scoring range of 300-850 A for scores between 900-990. Payment history is the most influential factor of your credit score at 35. Business credit is the ability of a business to qualify for financing. D for scores between.

Keep Your Credit Safe Protect Your Finances. Your credit score is a three-digit number that comes from the information in your credit report. A credit score is a three-digit number ranging from 300 to 850 which signifies your creditworthiness or your general ability to repay borrowed money. Ad Fast and Easy Access to Your Credit Report.

The score is one way banks credit card companies and other. The resulting scores and your credit file are used to determine your risk factor for future loans. Credit Scoring is a means of evaluating an individuals credit using a very sophisticated scoring process. Point it in the Right Direction with CreditCompass.

C for scores between 700-799. Rebuild Your Score With Trusted Comparisons. Credit Score Basics. Lenders will then use a score to assess how suitable a borrower you are for whichever product you have applied for.

Ask An Expert Why Don T I Have A Perfect Credit Score Nfcc

Komentar

Posting Komentar